Renters Insurance in and around Frankfort

Looking for renters insurance in Frankfort?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Frankfort

- New Lenox

- Mokena

- Manhattan

- Richton Park

- Tinley Park

- Orland Park

- Joliet

- Homer Glen

- Lincoln- Way area

- Will County

- Monee

- Peotone

- Manteno

- Green Garden Twp

- Channahon

- Shorewood

- Lockport

- Plainfield

- Chicago Heights

- Matteson

- Indiana

- Chicago

- Kankakee area

Calling All Frankfort Renters!

Trying to sift through savings options and deductibles on top of family events, your pickleball league and keeping up with friends, can be time consuming. But your belongings in your rented apartment may need the remarkable coverage that State Farm provides. So when the unexpected happens, your furniture, sports equipment and clothing have protection.

Looking for renters insurance in Frankfort?

Rent wisely with insurance from State Farm

Safeguard Your Personal Assets

Renters insurance may seem like the last thing on your mind, and you're wondering if having it is actually beneficial. But take a moment to think about how difficult it would be to replace all the belongings in your rented property. State Farm's Renters insurance can help when thefts or accidents damage your possessions.

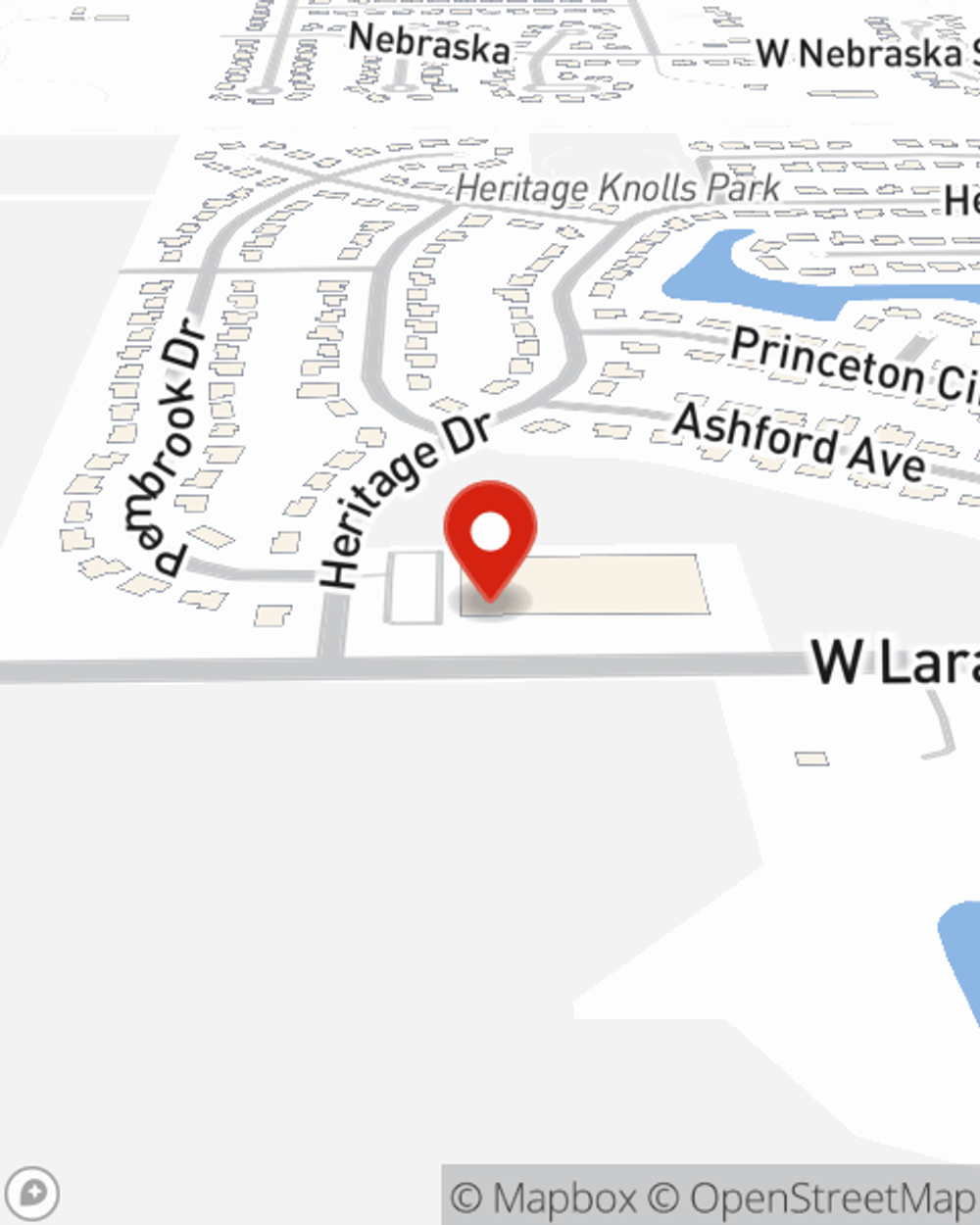

If you're looking for a dependable provider that can help you protect your belongings and save, get in touch with State Farm agent Terry Gross today.

Have More Questions About Renters Insurance?

Call Terry at (815) 469-2525 or visit our FAQ page.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Terry Gross

State Farm® Insurance AgentSimple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.